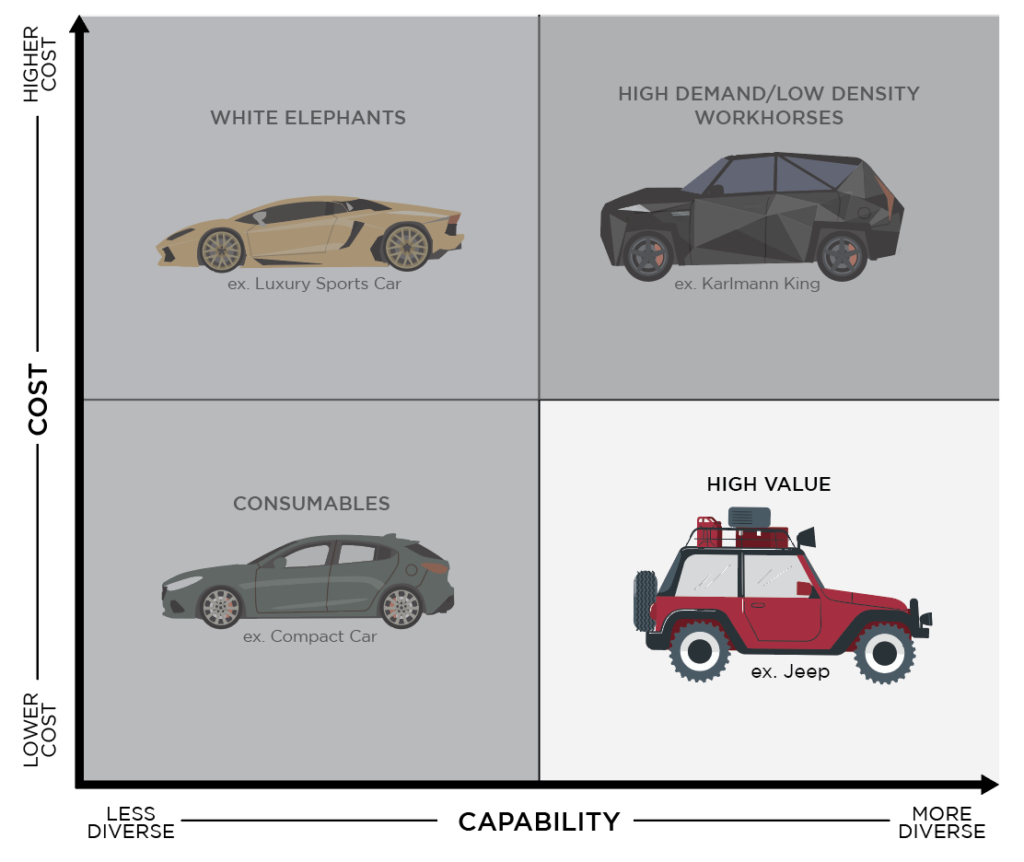

Innovations inevitably transition from bleeding-edge exclusivity to mass-market commodities as improved manufacturing and competition drive down costs. Savvy leaders understand where highly valued capabilities currently sit on this spectrum, ensuring investments target accessible innovations with favorable risk-reward ratios primed for scalable adoption. Let’s take a deeper look at understanding where these innovations fit into the cost vs capability matrix, focusing on quadrant 3.

Did you miss the rest of the series?

Part 1 Intro to the Cost Capability Matrix

Part 2 | Assessing the Cost-Capability Tradeoff, Quadrant 1 – Consumables

Part 3 | Navigating the Cutting Edge: Investing in Specialized Innovation, Quadrant 2 – White Elephants

Insights into High Value

Quadrant 3 represents the commercial sweet spot spanning novel yet increasingly standardized capabilities with expanding mainstream utility. For budget-conscious leaders seeking maximum capability per dollar spent, Quadrant 3 offers optimal bang for the buck – modernized solutions squeezing every bit of value from investments by bridging customizability and economies of scale.

Whether pursuing technology upgrades or new solution procurement, targeting innovations sliding down adoption curves unlocks the best of both worlds – substantial capability advancement at palatable price points minimized through commodification. Building in customizability broadens the applicability of the system to wider use cases to extract full utility from existing investments.

Moreover, commoditizing innovations through flexibility and customization provides organizational agility to tailor solutions perfectly with specific requirements. The savings accrued from maximizing adoption lifetime value frees up funds for additional capability enhancements or innovation investments in the future – and creates dynamic advancement built on firm fiscal foundations.

By proactively targeting solutions transitioning from early niche audiences to mainstream viability, leaders avoid overspending on exotic innovations while sidestepping stagnant antiquation. Instead, real material progress emerges as prudent investments harness commodification’s compounding savings and flexibility dividends to scale organizational capabilities over time systematically.

The key insight for leaders lies in evaluating emergent capabilities by the trajectory and velocity of their value rather than technical specifications alone. Prioritizing innovations reaching the knee of hockey stick adoption curves allows tapping into explosive demand built on proven multi-context utility.

With appetites for sophisticated new functionalities balanced against moderate risk tolerances, early adopters validate solutions demonstrating burgeoning market viability. Take smartphones transitioning from luxury to essential, streaming proliferating beyond early niche followers, and solar energy expanding from eco-enthusiasts to cost-conscious households. In each case, engineering and positioning transformed exotic innovations into flexible mass-market commodities traded on improving price-performance ratios.

Practical Application

Plotting existing capabilities against Quadrant 3 allows leaders to identify emerging innovations ripe for adoption and scale. Analyzing through this lens highlights solutions fit for flexible customization, standardization, and volume deployment – prime targets for maximizing capability bang for the buck. Leaders can assess innovation velocity, utility trajectory, and price elasticity to prioritize commoditizing opportunities on the cusp of explosive hockey stick growth. Comparing organizational solutions against market alternatives re-emphasizes gaps in Anchoring innovation investments to this high-value nexus and fuels aggressive capability advancement at minimizing price points before niche innovations become exclusionary.

Questions a leader should consider:

- Which emerging innovations demonstrate a clear trajectory towards commoditization that we should evaluate for adoption and scaling?

- How could we enhance flexibility, configurability, and customizability in our existing solutions to improve applicability across diverse use cases?

- Where do opportunities exist to consolidate contracts around standardized capabilities with multiple vendors to improve purchasing power?

- How can we leverage volume licensing, bulk pricing, or other economies of scale to reduce costs further as we broaden the deployment of valuable capabilities?

- Do our software development, testing, and release cycles allow rapid integration feedback and new features prioritizing user needs as capabilities commoditize?

- How frequently are we testing the market for replacement solutions as existing ones transition from differentiation to commoditization?

- What risks of disruption do we face if failing to adopt new high-value commodity solutions prior to reaching the scale ceiling with current ones?

- Across stakeholders benefiting from common, scalable capabilities, are governance and funding properly aligned to share responsibility and cost savings?

Proactively asking these questions focuses technology investments on the dynamic high-value center of the market. This prevents leaving money on the table during invaluable windows when tailored adoption at scale is possible before niches become exclusionary or obsolete.

Rather than chase exotic innovations or settle for antiquation, alignment to Quadrant 3’s mix of customizability and enlarging scale offers attractive middle paths for optimizing capability growth. Leaders realize the best of both worlds – substantial capability advancement at minimizing price points via commodification – for aggressively taking advantage of emerging opportunities. Next, we’ll examine our last quadrant, High Demand/Low-Density Workhorses.